Haudecoeur

Haudecoeur is the leading ethnic food company in France. It has over 3,000 references and strong brands (e.g., Samia, Riz du Monde, Legumor, 555) dedicated to customers with foreign origins.

Objective

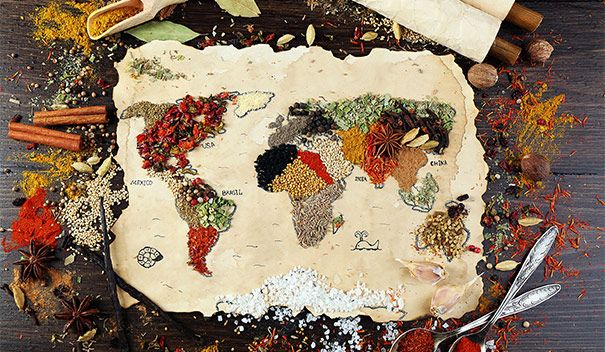

Invest in the undisputed leader in the French ethnic food market with a strong historical track record (long-term growth and proven cash flow generation) and significant growth potential (e.g., products range expansion, further geographical penetration, M&A, etc.), benefitting from the resiliency of the food sector in general and the strong underlying growth of the ethnic food market. True partnership with the Haudecoeur family (involved at the Board of Directors) and a new and strong management team installed in light of this primary transaction.

Increasing Market Cycle Risk; Demographics, Economic Development & Aging population

France

Consumer